Frontiers in Corporate Finance for Latin

American Executives

Increasing Corporate Value

Through Financial Risk Management

Prof. Ian Giddy

New York University

How can Latin American corporations and their bankers increase shareholder

value by better management of the amount and kind of debt they have, and

by using derivatives appropriately?

Selected Readings:

Schedule and Case Study Assignments

Increasing Corporate Value

Through Financial Risk Management

Stern School of Business

New York University |  |

| Topic | Remarks |

|

-

The Emerging Market Crisis: Corporate Financial Bets that Destroyed Value

-

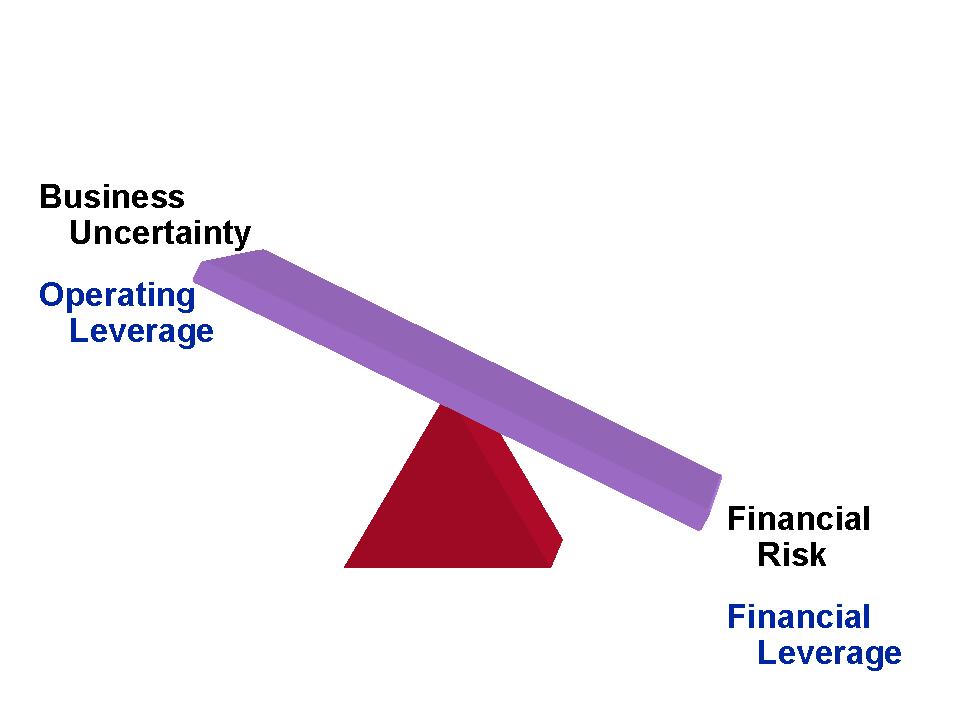

Increasing Value, Part I: Managing Financial Leverage

| Discussion of Sammi Steel and TPI cases |

| Lunch |

|

|

-

Increasing Value, Part II: Managing Financial Market Risks

-

Conclusion: A Roadmap for Corporate Value Improvement

| Discussion of Frutas Amazonas, Pesces and Ban Pu cases |

Case Study: Xerox

Assignment: How should this company finance itself for future survival

and growth?

Case Study: Thai

Petrochemical Industry

Assignment: TPI, the heavily indebted Thai company, is under pressure

to recapitalize. Having completed a restructuring of its debt, the company

plans to reduce its debt/equity ratio to below 0.5 by the end of 2000.

How can this be done? What method should it use to ensure the company's

long run survival? What can be learned from the way Siam

Commercial Bank has approached its refinancing?

Case Study: Frutas

Amazonas

Assignment: How should this Peruvian company finance its exports to

Spain? Should the debt be hedged?

Case Study: Exportadores

Pesces de Concepcion

Assignment: In what currency should Chile's salmon exporters finance

their exports to Japan? Pesos? Yen? Dollars? Krone?

Case Study: Ban Pu Coal

Company and Exhibits

Assignment: How much debt should this Thai company have? What is the

recommended maturity, interest contract, and currency to finance Ban Pu’s

Mai Moh project and future expansion?

View the PowerPoint

Presentation

|